6 Most Popular Payment Methods in Spain

Familiarity with the most popular payment methods in Spain is crucial for small business owners looking to expand into the Iberian peninsula. Offering customers’ preferred local payment methods is a key way to meet expectations and enhance the customer experience.

As technology advances and consumer preferences evolve, a diverse range of payment methods have emerged to cater to the needs of Spanish consumers. Be prepared to adapt to these changes as you enter the Spanish market.

1. Credit and Debit Cards

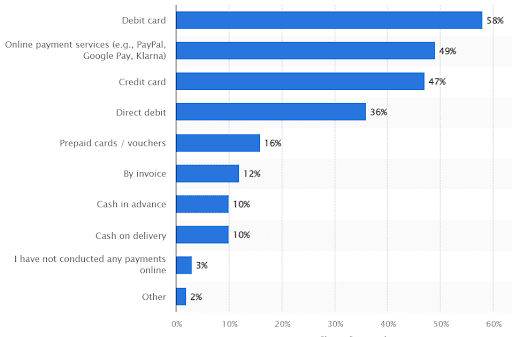

Credit and debit cards together are the most used payment method for retail purchases in Spain. According to the Banco de España, 67% of retail payments in Spain were made with payment cards in 2023. The following table shows the top payment methods for online payments in Spain in 2024:

Debit cards are the leading payment method for online transactions in the Spanish market. This data shows how important it is for Spanish businesses to accept a wide range of payment cards as well as other digital payment methods.

The Importance of Accepting Foreign Cards in Your Spanish Business

Businesses based in Spain must accept foreign credit and debit cards to stay competitive. In 2022, 10.4% of revenue in Spanish e-commerce businesses came from abroad. This means that businesses based in Spain must cater to Spanish and foreign consumers alike.

Accepting a wide range of foreign payment cards is also critical for businesses with a high-street presence. Spain received 73.9 million visitors in the first nine months of 2024. These visitors understandably want the option to pay with cards from their own country and in their own currency.

Businesses require a payment processor with an integrated global payment gateway to handle different payment methods in different currencies. This technology allows you to accept your customers’ preferred payment methods. It also facilitates accepting alternative payment methods to ensure you can process your customers’ payments no matter where they come from.

Spain’s booming tourist industry is just one of the pros of starting a business in Spain. Businesses ready to serve both the Spanish market and visitors to Spain will find opportunities ripe for the taking all around the country.

2. Bizum

Bizum is a convenient, fast, and secure instant payment service. It primarily facilitates peer-to-peer money transfers via a mobile phone. Bizum allows individuals to send and request money transfers without asking for a bank account number. Instead, all that users need to send money is the recipient’s mobile phone number.

Bizum is one of Spain’s most successful solutions for mobile payments, with 82.5% of young people stating their intention to use the service. It’s fast replacing cash and other payment methods as it offers an easier way to split restaurant bills, pay rent, or settle one-time expenses.

Bizum for Merchants

Some businesses are also using mobile payment types like Bizum as a way to go cashless. This is especially true of service businesses like salons where business owners and clients have a more familiar relationship.

E-commerce merchants are also increasingly offering this convenient system. Merchants must request a virtual POS from their bank to offer Bizum as a payment method. Accepting Bizum payments comes with some fees, which can be paid as a fixed yearly rate or via a low transaction fee for each transaction received.

Remember that Bizum is only available to customers with a Spanish bank account. Be prepared to offer other payment methods to cater to foreign and unbanked customers.

3. Bank Transfer

Bank transfers are another popular payment method in Spain. Compared to Bizum, bank transfers may seem inconvenient. However, they’re a great way for merchants to handle subscriptions and recurring payments. Your payment gateway will handle your customers’ recurring payment plans and keep their personal data secure.

Bank transfers are a secure and efficient payment method. According to research from JP Morgan, they’re the third most popular payment method in Spain, with an expected 21% market share by 2024 (page 101 of the PDF).

Bank transfers are still popular as they allow customers without access to major credit or debit cards to pay for goods or services digitally. They offer instant payment with less risk of chargebacks and declined payments.

4. Cash

Cash remains king in Spain. Research from the Banco de España suggests that 60% of the population used cash payments at physical points of sale in 2023, making them the most popular in-store payment method. Cash was used on a daily basis by 65% of the population in the same year (page 3 of the PDF).

Interestingly, various demographic factors influence when cash payments are used:

- Cash is the most popular payment method for 76% of over 65s. This compares to 36% of people in the 25-34 age group.

- Cash use declines as educational attainment levels rise. 74% of people with primary education predominantly used cash, compared to 44% of those with university education.

- Inhabitants in smaller towns tend to use cash more. 67% of people living in towns with populations of fewer than 10,000 inhabitants used cash as their primary payment method. This compares to 61.4% in towns with between 10,001 and 100,000 inhabitants and 54.5% of those living in larger towns or cities.

Cash is also popular for specific types of transactions. For example, cash payment on delivery is an established way to pay for home-delivery services like takeaway food.

5. Direct Debit

In Spain, direct debits, or “domiciliación bancaria,” are widely used for a variety of recurring payments. This convenient payment method automates the process of paying bills, ensuring timely payments and avoiding late fees.

Here are some of the most common uses of direct debits in Spain:

- Utility bills: Electricity, water, gas, and internet bills are often paid through direct debit.

- Mobile phone bills: Many mobile phone contracts allow for automatic payments via direct debit.

- Rent payments: Landlords often prefer direct debit payments for rental income.

- Insurance premiums: Insurance companies frequently offer direct debit as a payment option.

- Gym memberships: Gym memberships can be paid through direct debit, ensuring consistent payments.

- Subscription services: Streaming services, online newspapers, and other subscription-based services often use direct debit.

- Taxes: Some taxes, such as property taxes, can be paid through direct debit.

The number of direct debits has stayed relatively stable over the last ten years. Direct debits accounted for 2161.92 million transactions in 2023.

6. Buy Now, Pay Later

Buy Now, Pay Later (BNPL) is growing in popularity among cash-constricted consumers. Klarna launched in Spain in 2020 and Clearpay entered the market a year later.

BNPL offers consumers the opportunity to divide up or defer in-store or online purchases. Consumers are offered immediate approval and credits with nominal or no interest or fees.

The main advantage BNPL offers is financial flexibility as it means consumers can pay for their purchases at a later date. However, consumers must be aware of the late payment interest and default fees if they fail to pay the agreed instalments.

BNPL transactions in Spain are projected to be 15% higher in 2024 than in 2023. This increase is projected to rise as consumers look for more flexibility in their payment options.

Spain’s E-Commerce Market Is On the Rise

Spanish consumers and businesses alike are embracing the turn towards e-commerce. Revenue in the Spanish e-commerce market is expected to reach US$35.50bn in 2024 and show a compound annual growth rate of 9.73%. This will result in a projected market volume of US$56.46bn by 2029.

This growth underlines the importance of taking your business online. It is also essential to keep up with industry trends and customer expectations by offering a range of online payment methods to remain competitive.

Meet Customers’ Payment Expectations in Spain

Spanish business owners must be willing to accept payments according to their customers’ preferences. The payments market is constantly evolving, meaning business owners must be prepared to adapt to the times.

For Spanish companies, this will inevitably involve adapting to the domestic and international markets. Choose payment processing solutions that cover all the bases and help to boost your success in Spain.

Published: November 21, 2024

Last updated: January 3, 2025